Many clients have diligently saved for retirement and now the rules are changing. The ability to transfer accumulated retirement funds to their children and grandchildren are limited by The 2019 Setting Every Community Up for Retirement Enhancement Act (SECURE Act). The Act has created a greater tax burden for IRA account holders’ heirs.

(See how your retirement accounts are impacted by the SECURE Act by participating in this survey: Retirement Tax Analyzer)

What Does the Secure Act Do?

For those with IRAs, the Act largely eliminated the ‘stretch’ inherited IRA strategy. Instead of a non-spouse heir being able to stretch the distributions from an inherited IRA over their lifetime, they now only have 10 years to empty the entire account.

Inherited IRA beneficiaries are impacted through this shortened, 10-year distribution period via:

- larger distributions over a shorter period;

- increasing taxable income of the beneficiary;

- potentially increasing the marginal federal tax rate; and,

- reducing the time funds inside the account have to grow tax-deferred, resulting in less growth for the beneficiary.

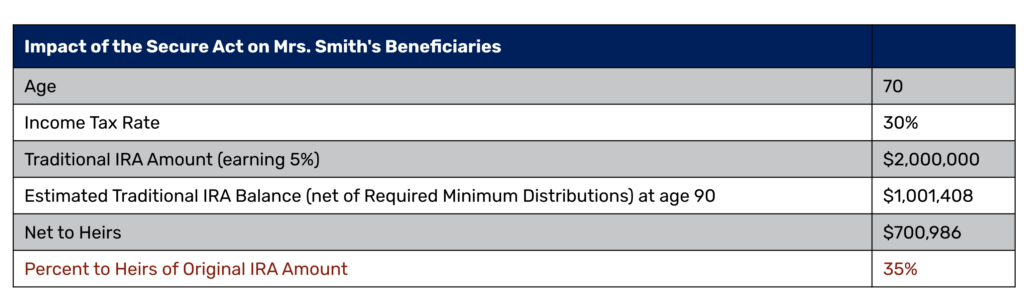

The table above (along with the assumption and analysis below) illustrate the “potential income-tax drag” resulting from the Secure Act of 35%.

Tax Solution to the Secure Act

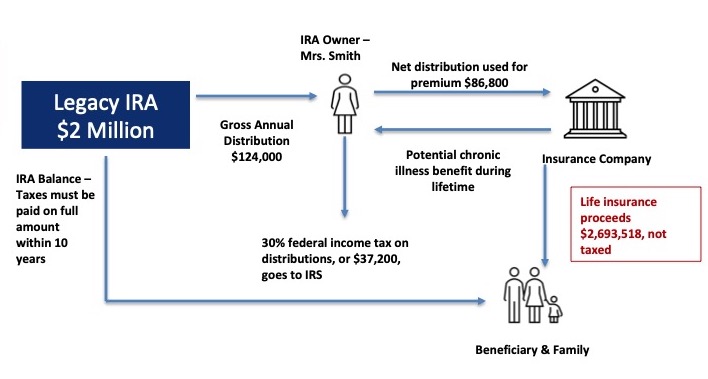

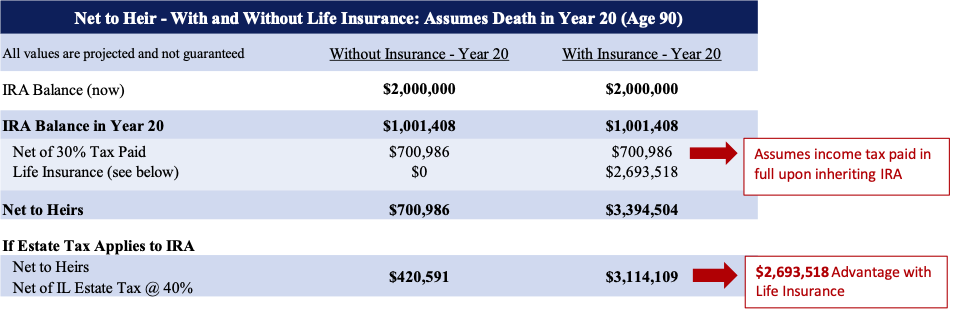

IRA owners have an opportunity to create tax free income for their heirs by using life insurance. Given the Act requires an IRA owner to make minimum distributions (RMDs), what if the IRA owner used all or part of their RMDs to fund the purchase of a life insurance policy on their life? The beneficiary of the policy would be their heirs, either directly or from the trust. The policy death benefits would be paid to their heirs income tax-free. The result is: the replacement of fully taxable required distributions from an inherited IRA with income tax-free life insurance death benefit proceeds (possibly estate tax free).

The life insurance proceeds reflected above are based on the current dividend rate of 6.10% at age 90 and purchasing paid-up additions with the annual dividends. Assuming a guaranteed dividend rate of 4.00%, the guaranteed death benefit is $1,761,720.

How Much Will You Lose to Taxation?

You are invited to receive a free income tax assessment of your retirement accounts by participating in this survey: Retirement Tax Analyzer

Advisory services offered through Spearhead Capital Advisors, LLC. Securities offered through Spearhead Capital, LLC. Member FINRA/SIPC. Please review Spearhead’s website for complete disclosures: Complete Disclosure Statement. Spearhead and JNJ & Associates, Ltd. are not affiliated by ownership.